Sequoia Superannuation Service For Mortgage Brokers, Stock Brokers, Financial Planners & Accountants

Sequoia Superannuation has many options for Mortgage Brokers, Stock Brokers, Financial Planners & Accountants. Our solution is simple. We will build a service around what you want. If branding is important for you then this can be done. If you wish to adapt our service to meet your business & clients needs this also can be done. We are here to partner with you and we understand that it is important for us to fit into your business & service model. We have a few suggestions below of what we offer however let us know what you want & we will do our best to build this for you.

Sequoia Superannuation has many options for Mortgage Brokers, Stock Brokers, Financial Planners & Accountants. Our solution is simple. We will build a service around what you want. If branding is important for you then this can be done. If you wish to adapt our service to meet your business & clients needs this also can be done. We are here to partner with you and we understand that it is important for us to fit into your business & service model. We have a few suggestions below of what we offer however let us know what you want & we will do our best to build this for you.

Sequoia Superannuation

The easiest way to start using Sequoia Superannuation is to use our current services. This is where most Accountants, Mortgage Brokers, Stock Brokers & Financial Planners start. You can use Sequoia Superannuation current offering and promote this to your client base. This includes Sequoia Superannuation Mini & Classic offering. We also can do year end work for you as well if that is the preferred method of your client.

Co-Branded Solution

For many service providers a co-branded solution is the way to go. We often find many service base firms such as Mortgage Brokers, Stock Brokers & Financial Planners wish to co-brand our services. This solution involves adding your brand to all of our documentation including marking documentation. We can also assist you in adding a client login section to your website in order to drive traffic to your site and not ours. Again phone or email us to see how we can help you.

White Labelling

With this solution Sequoia Superannuation will customise our offering to work for you. We will adapt all our documentation, marketing materials and our online access to meet your specific needs. All documentation will be provided to you and will be tailored to include your branding. This service is fully tailored to your specific needs. Call us and we will work together to find the right solution for you. By doing this, not only will it make you look like a holistic professional service, it will keep your clients coming back to your website 24/7. In turn driving up your Google search engine optimisation (SEO), helping to create new business.

Increase Your Revenue

Add extra revenue to your business with SMSF admin margins.

Technology

Sequoia deploys market leading technology to its clients, making reporting, trading and document management a breeze.

Documents At Your Fingertips

No more searching for trust deeds or financials. All stored and accessible 24/7 from our systems.

Service

Sequoia is 100% locally serviced. No offshoring.

Our team provides prompt turnaround and technical expertise.

Time

Take back your time. Leverage Sequoia’s systems and expertise to allow you to get back time to concentrate on things that are important to you.

Main Services

Sales Team Assistance

Other than being a full service SMSF administration firm (SMSF setups, Custodian (Bare) Trusts, Ongoing accounting/administration/financials tax returns etc), we offer a full AFSL Licenced sales team to provide General Financial Advice (through our sister company Sequoia Asset Management) to your clients to help them get their SMSFs up and running, including rollovers, so they can invest as instructed/directed by you. This is a major advantage over our competitors.

We are also:

1) Available for seminars to speak about Superannuation/SMSFs or buying property with an SMSF, and are licenced to do so with our AFSL (Australian Financial Services Licence)

2) Available to write technical pieces on SMSFs/SMSF Property – that can be used to send out to your databases to attract SMSF sales.

3) Sequoia Asset Management only provides general advice, so if you have a lead that is keen to buy/implement one of your investments/strategies, we will not get in the way and provide a financial plan that puts restrictions/diversification rules on the client (Advisers that provide Full Personal Advice, not General Advice, will be required to do this and produce a Statement of Advice SOA).

4) Have an Online Lead Submission Portal so you can monitor the progress of your leads. For a free demo please ask. Once the SMSF is set up and funds roll in, we notify you to finish the purchase/implementation of your investments/strategies.

Corporate Trustee And Bare Trust (Property Trust) Establishment

A Bare Trust deed is an important legal document that ensures the proper arrangements are in place for the SMSF to borrow funds for the acquisition of the property. Sequoia Superannuation can facilitate the set up of the Bare Trust for your clients quickly and effortlessly, as well as the required corporate trustee.

Mailbox Service

In order for us to provide efficient and accurate up-to-date reporting for you & your clients SMSF Sequoia Superannuation acts as the mailbox. This way all important information is received by us fi rst and is electronically stored on your clients SMSF file.

Bookkeeping

Sequoia Superannuation reconciles your clients SMSF on a daily basis. By receiving an automated feed from your clients SMSF bank account showing all transactions such as rental income, property expenses, insurance summaries, contribution data etc we are able to provide your clients a high quality bookkeeping service that backs into our state of the art online reporting system.

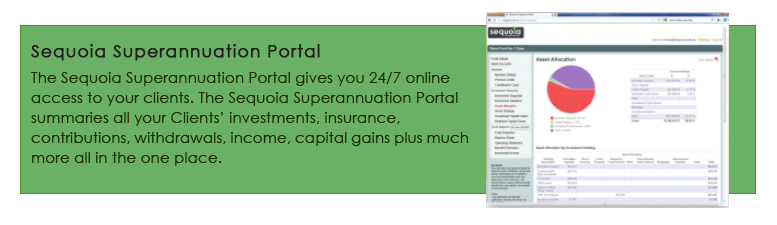

Online Reporting

Sequoia Superannuation provides you the adviser access to our Adviser Portal. This portal allows you to track your clients SMSFestablishment, access key documentation, track outstanding querries and most importantly you will be able to see everything about the SMSF. This includes all SMSF details, member details, all bank transactions, investment transactions, income statements, insurance summary, contribution flows, profit and loss, balance sheet and much more.

Financials Preparation

At the end of each financial year SMSFs are required to complete, audit and lodge financials with the ATO. Through our team of dedicated accountants, Sequoia Superannuation prepares and facilitates all of this for your clients.

Auditing Services

Sequoia Superannuation will arrange the audit of your clients SMSF from a panel of auditors. All auditors are external to Sequoia Superannuation.