Sequoia Money Market

Sequoia has teamed up with Australian Money Market (AMM) to provide you an online cash solution to easy invest in term deposits and at call bank deposits. AMM is Australia’s leading independent cash platform that has over 17500 clients and now over $2.8 billion invested in various bank accounts and term deposits.

- Automatic completion of all application forms and contract notes (after the initial account with Sequoia Money Market is opened)

- Same day portability of funds between institutions upon rollover that enables you to continually maximize interest earned

- Wholesale rates on all deposit amounts from banks are in one place allowing you to shop for the best rate at a glance for the best return, allowing certainty of earnings and savings.

- Tax Reporting of financial transactions provided at the end of the tax year without any transaction fees

As the specific information is not listed in the Act, each institution has their own process in complying with identification laws. AMM requires that we receive appropriate ID combinations with every new account. This will ensure that the ID requirements are met for all institutions we deal with.

The ID is then stored by AMM to pass to each institution when deals are instigated. We will need to update ID documents as they expire and will contact you accordingly.

The Anti-Money Laundering and Counter-Terrorism Financial Act 2006 requires that financial institutions collect and verify specific information about their clients.

The cash management account acts as a hub account to the system and enables the easy flow of funds between financial institutions. With each account the funds are always held in your name.

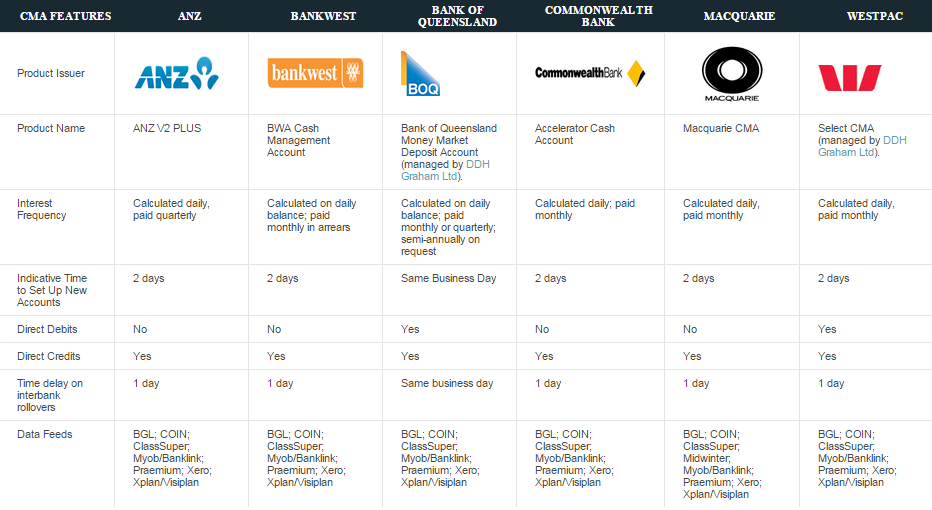

AMM currently offer the following choice of cash management accounts.

When you complete the online application form you will be asked to choose an account, read the relevant PDS or Terms and Conditions and provide a copy to your client. Please note that Commonwealth Bank is only available to your clients that have existing CBA Accelerator Cash Accounts.

AMM simple switching process allows you to maximise returns and avoid having term deposit funds automatically reinvested at lower non-competitive rates with the same institution.

The benefits of actively managing your cash deposits include:

- Enabling you to continually maximise interest earned

- Obtaining the most competitive rate available in market at each rollover

- Advance notification of upcoming maturities

- Automatic transfer of funds between institutions

- Minimise administrative costs

AMM wi ll contact Sequoia a week prior to any maturing investment. Upon instruction, AMM will either reinvest the funds into the institution and deposit of your choice, or redeem the funds as required. AMM never automatically rolls over the funds and therefore avoids significant risk of the investment rolling over from a high interest rate to a low interest rate with the same institution. If no instructions are received, funds are returned to your cash management account to await further instructions.

ll contact Sequoia a week prior to any maturing investment. Upon instruction, AMM will either reinvest the funds into the institution and deposit of your choice, or redeem the funds as required. AMM never automatically rolls over the funds and therefore avoids significant risk of the investment rolling over from a high interest rate to a low interest rate with the same institution. If no instructions are received, funds are returned to your cash management account to await further instructions.

On placing a deal you will receive a confirmation via email.

From AMM secure website you can place your term deposit & all call deposits.

Once your login and accounts are setup, you are ready to start trading.

Choose the term and institution that suits your client. You can filter the rates by type of financial institution. The “Highest Rate” for each term across all the providers is automatically displayed. The rates are initially displayed in order of the best 3 month rate but can be changed by clicking on any of the term headings.

This is where you confirm the details of the deal. You can download the PDS or Terms & Conditions document for the chosen institution and Financial Services Guide (FSG). A copy of the PDS will be sent to you via email. On acceptance of the deal, the funds will be deducted from your cash management account balance and the deal will appear in the list of Term Deposits on the Current Investments Page.

Step 3: Deal Confirmation

You will receive an email confirming the deal. The chosen institution will send out a separate bank confirmation to you via the email address provided.

A new account can be opened in any of the following entities.

- Individual – you can select 2 or more individuals to hold a joint account. Tax file numbers (TFNs) or an exemption reason will be required for all individuals.

- Superannuation Fund – the superannuation fund name must be provided along with the TFN and ABN for the fund. The Trustee type can be either individuals or a company.

- Trust – the trustee type may be individuals or a company. The trust TFN and ABN is required.

- Company – the full company name is required along with the company ABN, ACN and TFN.

- Incorporated Association/Non-profit – the full company name is required along with the company ABN, ACN and TFN..

- Sole Trader – the full trading name is required along with the ABN and TFN.

- Formal Partnership – you can select up to 3 partners. A TFN is required for the partnership itself, not the individual partners.

- Government Body – up to 3 authorised signatories can be included. The company ABN, ACN and TFN is required.

The Anti-Money Laundering and Counter-Terrorism Financial Act 2006 requires that financial institutions collect and verify specific information about their clients.

AMM collect your personal information & identification in the initial application process. Copies of your identification are provided to each institution as deals are placed. We will contact you to update your ID documents when they expire.

The information required to open an account is stored securely within AMM & our database. AMM does not use the information for any other purpose unless specifically instructed.AMM follow strict security procedures in both the storage and disclosure of personal information and fully observe our responsibilities and obligations as required by the Privacy Act 1988 which regulates the collection, storage, quality, use and disclosure of personal information.

The initial application form is the only application form you are required to sign. This single application form provides access to the rates of all the institutions we deal with and gives AMM the authority to open investments with all institutions in your name. You will receive confirmations from the institutions as if you dealt with them directly. SMM collect your identification in the initial application process, and provide copies to AMM & each institution as required. (Add link to download the relevant application form, Also make part of this download our FSG – FSG to be provided).

AMM easily moves funds between financial institutions via your Macquarie Cash Management Account. Where you already have an existing cash management account other than Macquarie, this can also be linked. After receiving instructions from you we will instruct AMM to act on your instructions where funds will be transferred and deposited into your chosen institution to gain the best interest rate available at the time. All investments, including the cash management account, are held in your name and you receive a confirmation directly from the institution providing the term deposit or at call bank deposit. When an investment reaches maturity, it can be reinvested without the need to complete further application forms with any one of over 20 Australian institutions. Alternatively funds can be redeemed and passed back to your pre-nominated personal cheque/savings account.

We offer you the flexibility to place deals online from anywhere, anytime. The deals will then be processed during AMM standard dealing times. Whether you are in the office, or on the move, you can connect and transact.

We offer you the flexibility to place deals online from anywhere, anytime. The deals will then be processed during AMM standard dealing times. Whether you are in the office, or on the move, you can connect and transact.

The AMM term deposit management platform provides centralised access to interest rates (including daily specials) offered by more than 20 banks, building societies and credit unions. The choice of institutions continues to grow and are all Approved Deposit Institutions covered by the Government Guarantee Scheme.

The AMM term deposit management platform provides centralised access to interest rates (including daily specials) offered by more than 20 banks, building societies and credit unions. The choice of institutions continues to grow and are all Approved Deposit Institutions covered by the Government Guarantee Scheme.

Introduction To Australian Money Market

Check out these forms available for download: